Free Indians In Amity with the State: A Legal Legacy

Processing Request

Processing Request

The phrase “free Indians in amity with the state” arose during the early years of the Carolina colony to describe peaceful Indigenous people who possessed certain inalienable civil rights. Legal measures enacted during the early eighteenth century to protect those rights were revived during the nineteenth century by free persons of mixed African descent who embraced their Indian ancestry to augment their own civil liberties. In the twenty-first century, the legal legacy of these descendants of amicable Native Americans continues in ongoing conversations about genealogy and racial identity.

The concept of “amity” or friendly relations between nations is an ancient feature of human civilization predating recorded history. Amity forms one pole of a simple dichotomy: collective societies, which we might call tribes, states or nations, recognize their neighbors either as friends or as enemies. Nations defend and protect neighboring states with whom they share a bond of amity, and they wage war against those deemed enemies. European colonists streaming across the Atlantic Ocean in the sixteenth and seventeenth centuries applied this ancient rule to the Indigenous people of the Americas, albeit inconsistently. By the time of the creation of the Carolina Colony in the 1660s, English adventurers exploring the landscape strove to identify as quickly as possible which Natives tribes were friendly to the encroaching colonists and which were not.

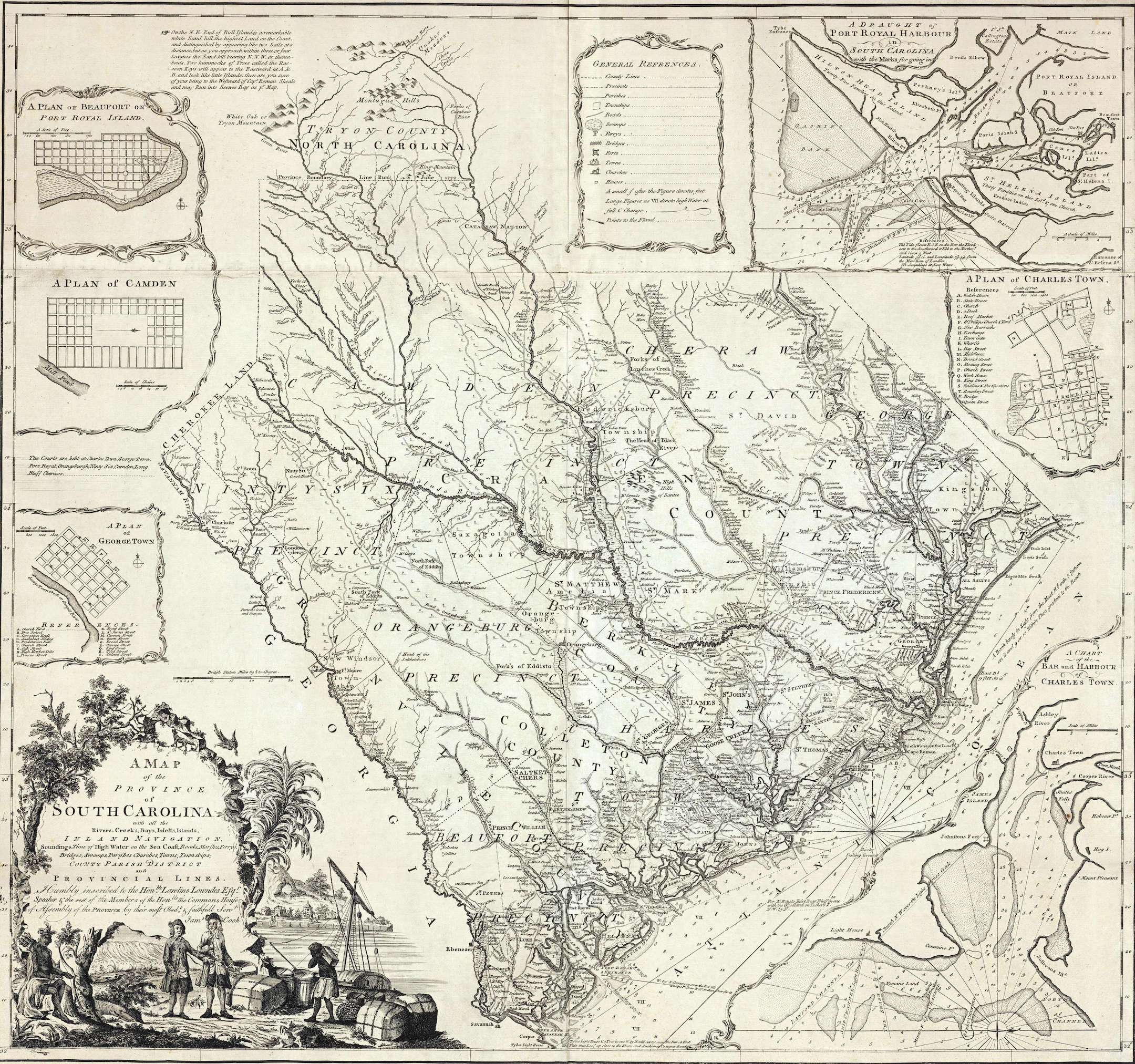

Immediately after the creation of Charles Town on the Ashley River in 1670, the nascent government of South Carolina settled agreements of peace and friendship with neighboring “nations” of Indigenous peoples. Those who passively shared or ceded the landscape to European settlers, like the Kiawah, Etiwan, and others, were permitted to live among and trade with White colonists in a state of amity. On the other hand, those who used violence to resist the process of colonization, including the Kussoe and Westo, were treated as hostile enemies to be banished or enslaved. Indian slavery emerged in the 1670s as a small component of the burgeoning trade between Carolina colonists and Native Americans, generally involving the enemies of Indians in amity with the provincial government, who were captured on the outskirts of the English colony and delivered to White settlers for sale.[1]

Commerce between colonists and Native Americans in South Carolina became an important stream of revenue during the late seventeenth century, facilitated by White traders who exchanged trinkets, hatchets, guns, textiles, and alcohol for deerskins and other pelts sent to the port of Charleston. Spending the majority of their days among the natives and out of the sight of government authorities, many of these traders earned a poor reputation for their abusive treatment of the Indians. Tribal leaders in the 1690s and early 1700s repeatedly brought to Charleston a growing tally of grievances, accusing the worst of the traders of defrauding, beating, kidnapping, and raping the Indians who lived “in amity” with the colonial government.[2] Edward Randolph, who had been sent to investigate colonial administration, submitted a report to the English government in the spring of 1702 recommending that Queen Anne seize custody of Carolina and other proprietary colonies to ensure their better government, and “to appoint prudent governors, and particularly in Carolina, with instructions to treat those Indians in amity with them, who are a free people, with justice and tenderness.”[3]

At the heart of the matter was the increasing trade in enslaved Indians, brought to the Carolina market around the turn of the eighteenth century by the Yamasee people, who preyed on neighboring tribes allied to the Spanish and the French. In an effort to curb abuses perpetrated by traders who led “loose, vicious lives, to the scandal of the Christian religion,” and to quash the nefarious native slave trade, the South Carolina government passed a law in 1707 to regulate the trade “among the Indians in amity with this government” and to “make it safe to the public.”[4] The law also created a board of Commissioners of the Indian Trade in 1707, but that body apparently did not convene until 1710, by which time the damage done to Anglo-Indian diplomatic relations was beyond repair.

The eruption of the so-called Yamasee War in 1715, an intertribal rebellion against the European settlers, finally curbed South Carolina’s trade in Native American slaves.[5] The two-year conflict also underscored the importance of fostering amicable relations between the provincial government and its Native American allies. When a large gathering of Cherokee and Creek Indians convened in Charleston in January 1727 to settle a peace treaty with the provincial government, for example, Cherokee leaders noted that two of their people, a boy and a girl, were held as slaves in the provincial capital. Members of the Commons House of Assembly immediately asked President Arthur Middleton, acting governor of South Carolina, to issue a proclamation “strictly prohibiting the buying of any Creeks or Cheerokees [sic] or any other Indians in amity with this government.” The provincial government purchased the Cherokee boy and girl from their putative owners and delivered them to the Cherokee delegation before their departure from Charleston.[6]

Indigenous people formed a sizeable proportion of South Carolina’s enslaved population during the first quarter of the eighteenth century, but increasing imports of enslaved Africans during subsequent decades quickly overshadowed their presence.[7] During this transition, enslaved Indians and Africans across the Lowcountry began producing generations of mixed-race offspring. White colonists described the product of Native American and African parents as a “mestizo,” borrowing a term from the Spanish colonies, often corrupted locally as “mustee.” Although historians now argue over the precise meaning of the word in various colonies in centuries past, the term “mestizo” was widely used in eighteenth-century South Carolina by people who could point to individuals with specific racial compositions living within their community.[8]

The rapid increase of the trans-Atlantic slave trade to Charleston, combined with subversive encouragement from the anti-English government of Spanish Florida, led to the bloody slave uprising in September 1739 known as the Stono Rebellion. Eight months after that traumatic event, the South Carolina General Assembly crafted a new statute for “the better ordering and governing” of enslaved people in the province, better known as the “Negro Act of 1740.” The first section of the lengthy law focused on the definition of who is and who is not a slave, the repercussions of which echoed across later generations. The law declared that “all negroes and Indians . . . mulattoes or mustizoes [sic], who now are, or shall hereafter be [enslaved], in this Province, and all their issue and offspring . . . are hereby declared to be, and remain forever hereafter, absolute slaves.” This sweeping clause included one very important caveat, however, making an exception for all “free Indians in amity with this government, and negroes, mulattoes and mustizoes, who are now free.” It also made an important declaration about the future lineage of slavery in South Carolina. Beginning in 1740, the law stipulated that the condition of all children—that is, whether they be enslaved or free,—“shall follow the condition of the mother.”

The statute of 1740 also prescribed a legal remedy for enslaved persons protesting their bondage. Any person claiming “his or her freedom” could petition the local Court of Common Pleas for the appointment of a White guardian, who could argue their case more effectively. In such cases, the law placed the burden of proof on the plaintiff—that is, the enslaved person claiming a right to be free—because the law “always presumed that every negro, Indian, mulatto and mustizo [i.e., mestizo], is a slave, unless the contrary can be made [to] appear.” The only exception to this rule, said the Negro Act of 1740, pertained to “Indians in amity with this government,” in which case “the burthen of proof shall lye on the defendant” or slave holder, not the person claiming his or her freedom.[9]

A brief example from the year 1764 illustrates the efficacy of these legal clauses. In November of that year, a port official in Charleston, Samuel Prioleau, brought to the attention of the local government a pair of young slaves recently imported “from the West Indies.” The boy named Joe and his sister, Nancy, said Prioleau, “belonged to the Musketto [sic] [tribe of Central America] in amity with the English & consequently not suffered to slavery.” Lieutenant Governor William Bull summoned and interrogated Joe and Nancy, who explained their family lineage and circumstances in “good English.” The pair had been “stole from their own country by the Spaniards” and taken to Havana, where they were captured and exported by British forces during the recent war. Governor Bull immediately ordered an investigation into the matter and offered Joe and Nancy “the Kings protection” until they could be transported back to their family in Jamaica.[10]

The so-called “Negro Act” of 1740 was revised several times in subsequent years and made a perpetual law of the State of South Carolina in 1783.[11] By that time, the various tribes or nations of Indigenous people that had populated the Lowcountry at the founding of the colony were effectively extinct. The only recognized Native American nations then existing in South Carolina were the Catawba and Cherokee who resided in the northwestern backcountry. Scattered throughout the state, however, were numerous mixed-race people—both free and enslaved—who could claim descent from one or more Native Americans ancestors.

At the same time, the state’s population of “free persons of color” expanded greatly during the last quarter of the eighteenth century. Most of those people resided within the corporate limits of the City of Charleston, where both the City Council and the South Carolina General Assembly levied an annual head or poll tax, commonly called a “capitation tax,” on all free non-White adults. As I described in Episode No. 224, the capitation tax was essentially a surcharge for the right to be free, levied on a population composed largely of mixed-race people who had once been enslaved or were the descendants of formerly-enslaved people. The amount of the annual capitation tax, imposed concurrently by both the state and the city governments, varied from year to year. The charge was not great, but it was an extra burden for people occupying a tenuous legal existence somewhere between the poles of slavery and full citizenship. The capitation tax also represented a sort of stigma, a reminder from the government that their freedom was imperfect and conditional.

There were clear benefits for free people of color to identify themselves as descendants of free Indians in amity with the state. Proving such origin could be difficult in an era before official birth and marriage records, of course, and interpretations of the state’s complicated racial code evolved over time. Nevertheless, dozens of free people of color tried to assert their Indian ancestry in complicated legal proceedings that merit closer attention. Exploring a few sample cases highlights the ambiguities of the law in a slave-based society, and they also provide valuable genealogical details of free people of color in Charleston who sought to reinforce their tenuous freedom and liminal legal status.

At some point during the early years of the nineteenth century, a free man of color named Adam Garden petitioned Charleston’s City Council to be exempt from its annual capitation tax. The loss of municipal records from this era during the Great Memory Loss of 1865 has obscured the details of his argument, but we know that Mr. Garden lost his case and continued to pay the annual tax. His name appears on legal record again in 1814, when he was arrested in Charleston and tried on a criminal charge in what was called a “Magistrates and Freeholders Court”; that is, an ad-hoc tribunal of White men convened for the trial of offenses committed by enslaved people and free people of color.[12] Adam pre-empted the trial with a novel defense: He moved the court for a prohibition against the venue, claiming that his status as the descendant of a free Indian in amity with the state entitled him to be tried in a regular court of law with a proper jury.

Witnesses summoned to the case testified that Adam Garden had been born into slavery and later purchased his freedom, but that his enslaved mother and maternal grandmother were in fact the descendants of free Indians. The identity and status of Adam’s father was irrelevant to the case because the Negro Act of 1740 dictated that the legal condition of the child followed the condition of the mother. Despite the fact that witnesses could not recollect whether Adams’s Indian grandmother had been enslaved or free, and despite the fact that Adam and his mother were both formerly enslaved, the White magistrates and freeholders judged Adam Garden to be “of free Indian descent,” and vacated their case against him.[13]

The success of Adam Garden’s case might have inspired another mixed-race man in Charleston to assert his rights in a court of law. In the spring of 1817, a free “mulatto” man named Ferdinand Ferrett revived a legal protest against the City of Charleston that he had lost in 1811. Ferrett, who made a living as a fruiterer in the city’s market, had arrived in Charleston during the 1790s with a large number of Black and White refugees from the French island colony of Saint-Domingue (now Haiti). He had never been enslaved, but, around the year 1810, the City of Charleston began assessing Ferrett for the annual capitation tax. With the aid of a White lawyer, Ferrett and other unnamed parties re-applied in 1817 for a court prohibition to restrain the enforcement of the city tax.

Ferrett testified that his father was a White man, and his mother was “a free woman of the East Indies,” then living at Cape Francois, “where her rights had never been questioned.” The judge had dismissed Ferrett’s protest in 1811 because the text of the city’s capitation tax ordinance at that moment levied the tax on “every free Negroe, or free person of colour, whether a descendant of an Indian or otherwise.” The phrase “Indian or otherwise” disappeared from the city ordinance in 1814, however, and, following the legal success of Adam Garden, Ferrett renewed his protest. In May 1817, judges granted relief to Ferrett and his unnamed co-petitioners, who never again paid the city’s capitation tax.[14]

The small but significant legal victories attained by Adam Garden and Ferdinand Ferrett could not have escaped the notice of other free people of color residing in urban Charleston, who formed approximately three percent of the city’s population. Garden’s case had demonstrated that descent from a free Indian in amity with the state endowed him with rights and privileges beyond most of his free non-White neighbors. Similarly, Ferrett’s Indian ancestry secured permanent relief from the burden and stigma of the city’s annual capitation tax. Other free persons of color claiming similar Native American ancestry must have celebrated these legal victories and aspired to secure further relief for the mixed-race descendants of free Indians.

On the 5th of January 1818, the state tax collector for the urban parishes of St. Philip and St. Michael, Samuel Burger, published notice that he was ready to receive annual returns of all taxable property in accordance with a state tax bill ratified in December 1817. In a post-script, Burger noted that “free persons [of color] are desired to report themselves” for the capitation tax. Defaulters who failed to report their property (or themselves) would be liable to a double tax.[15]

Shortly after the publication of this notice, six individuals agreed amongst themselves to refuse to pay of the state capitation tax, likely with the intention of provoking a test case in a court of law. John, Isaac, Henry, and Peter Mathews were the sons of a free mulatto widow named Mary Mathews. They were all in the 20s, and their mulatto father, Peter Basnett Mathews, had died in 1800.[16] Later in the year 1818, they were among the founding members of Charleston’s first African Methodist Episcopal (AME) Church.[17] The Mathews brothers were joined by Hannah Brown, unmarried, and her sister, Elizabeth “Betsy” Mushington, who were also in their 20s. Their living parents, Nancy Brown and Moses Brown, a well-known barber in Charleston, were both of mixed Indian ancestry, but the Negro Act of 1740 dismissed the status of the father in determining the legal condition of his children.

The sextet likely dispatched John Mathews, the eldest, to the tax collector’s office to report their taxable selves as requested. Instead of identifying himself and his colleagues as candidates liable to pay the $2 state capitation tax, however, Mathews apparently announced their intention to refuse payment. The six young men and women in question, he explained, were all descendants of free Indian women who had lived in amity with the State of South Carolina before the Revolutionary War and were therefore exempt from the tax. Collector Burger stated his opinion that they were not the descendants of such Indians and were therefore liable to pay the tax. Furthermore, if they failed to make a proper tax return acknowledging their liability to the tax by the second day of February, they would become liable for a double tax.

At this point John Mathews said to the older White tax collector something to the effect of “I’ll bet you one dollar [roughly equivalent to $24 today] we can prove that we’re descended from free Indians in amity with the state.” Burger said something along the lines of “I’ll take that wager—I’ll bet a dollar that you can’t prove yourselves to be Indians.” Mathews withdrew and joined his confederates. Perhaps they gathered at the Brown household on the south side of Price’s Alley, the backyard of which abutted the backyard of an elderly white widow named Mary Taggart (1740–1827). She had resided at what is now No. 41 Meeting Street since the early 1780s, around the same time that the grandfather of Hannah Brown and Betsy Mushington, a free mestizo butcher named Leander Fairchild, had purchased their property in Price’s Alley.[18] In conversations not recorded, the seventy-eight-year-old white widow agreed to make legal statements to support her neighbors’ tax protest.

On 3 February 1818, Mary Taggart voluntarily appeared before a local justice of the peace, John Hinckley Mitchell, to record a series of brief affidavits, several of which survive among the manuscripts held at the South Carolina Department of Archives and History in Columbia. Mitchell wrote that “Mary Taggart who being duly sworn, on the holy Evangelists on her solemn oath did depose testify and declare that she well knows Nancy Brown the wife of a free man of color named Moses Brown and that she is the daughter of a free born Indian woman named Betty who resided and lived in her family for many years.” In a separate but nearly identical statement, Mary swore “that she well knows Betsey Mushington who is the daughter of Nancy Brown the wife of Moses Brown who is the daughter of a free Indian woman named Betty who lived in her family [for] many years.” Similar affidavits for Hannah Brown and the Mathews brothers must have followed, but have not been located. The Mathews brothers, in short, claimed descent from a free Indian woman named Patty, whose origins are now obscure.[19]

Armed with sworn testimony of their Indian ancestry, John Mathews returned to the tax collector’s office and presented copies of Mrs. Taggart’s affidavits to Samuel Burger. The youth demanded the dollar that he had wagered, but Burger rebuffed the claim. The collector either refused to credit the memory of old Mrs. Taggart, or opined that the ancestry of the Mathews brothers and Brown sisters did not alter their liability to the state capitation tax. John departed without his one dollar prize, and Burger recorded the six protestors as tax defaulters. In July 1818, Burger submitted their names to the Sheriff of Charleston District as defaulters subject to pay a penal double tax. At some point in the subsequent months, the sheriff’s office prepared writs of execution to seize the property of all defaulters commensurate with the value of their respective unpaid taxes.[20]

In the meantime, John Mathews and his tax-avoiding confederates engaged the services a young White lawyer named Benjamin Faneuil Hunt (1792–1854). Benjamin, about the same age as his clients, was a native of Massachusetts who graduated from Harvard in 1810, moved to Charleston, and passed the bar in 1813. In 1818, shortly before he agreed to represent six free persons of color, Hunt was elected to the South Carolina House of Representatives.[21] The lawyer proposed a suit based on two points. First, he sought to prove that John Mathews had won his bet with tax collector Samuel Burger. Second, he sought to quash the execution lodged against their respective property. Before filing suit, however, Hunt revisited the testimony of Mary Taggart. He prepared three interrogatories (questions) for her, and on 24 February 1819, Hunt took Mrs. Taggart to the office of a local justice of the peace, F. S. Ward, to record her sworn testimony on paper before witnesses.

Hunt first asked if Mrs. Taggart if she knew of two women named Betty and Patty and of their status. Mary replied, “I knew Patty & her sister Betty before the Revolutionary War, they were free Indian women, & were in amity with this state.” Second, Hunt asked if Mary knew his clients to be the descendants of these free Indian women. Mary replied, “I know that Nancy Brown is daughter of Betty, & Mary Mathews [is the] daughter of Patty. That Hannah Brown & Betsey Mushington [are] daughters of the said Nancy Brown. That Mary Mathews had a great many sons, & believe these young men to be her sons. I do not know them particularly by name.” Having no further information to relay, Mrs. Taggart then scrawled her signature with a feeble hand across the paper containing a transcription of her answers.

On 10 May 1819, Hunt and his clients, John Mathews, Isaac Mathews, Henry Mathews, Peter Mathews, Hannah Brown, Betsy Mushington, and Nancy Brown, appeared in court in Charleston to protest being assessed for the state capitation tax due in 1818. The plaintiffs argued that they were not liable for this tax because they were the children and grandchildren of “two free Indian women in amity with this state before the Revolution, to wit Patty and Betty for a long time residents in and inhabitants of this state and by its laws and usages entitled to all the rights privileges and immunities of free persons & citizens.” Patty “had issue a daughter named Mary, who intermarried with one [Peter] Mathews and had issue John, Isaac, Henry, and Peter.” Betty “had issue a daughter named Nancy, who intermarried [with Moses Brown] & had issue the actors Hannah and Betsy.” In spite of sworn testimony supporting their claim, the plaintiffs stated, tax collector Samuel Burger had reported the plaintiffs as tax defaulters to the sheriff, who had lodged executions against their goods and chattel in lieu of payment. The plaintiffs sought to be relieved of the tax burden and asked the court to issue a “Writ of Prohibition directed to the said tax collector and sheriff to prohibit them from levying and collecting the said tax or proceed further touching the premises.”[22]

The collected material relevant to the case of “John Mathews et al. vs. Tax Collector of Charleston” was presented a jury of White men in mid-June 1819. Representing the defendant was South Carolina Attorney General Robert Young Hayne, who argued simply that the plaintiffs were not the descendants of free Indians. While both sides agreed that John Mathews and Samuel Burger had “wagered the sum of one dollar that the same is true and the said tax collector & sheriff wagered the said sum of one dollar that the same is not true,” the plaintiff’s attorney, Hunt, argued that the plaintiffs had proved their lineage and were “entitled to the sum of one dollar from the defendants who refuse payment.” After reviewing the sworn affidavit of Mary Taggart, the matter was submitted to the jury. On June 16th, foreman Gilbert Davidson reported their verdict: “We find for the Plaintiffs.” The court recorded the judgment several days later, and the matter concluded.[23]

John Mathews and his brothers, and the children of Nancy and Moses Brown, never again paid the state or city capitation tax levied on free persons of color. Their legal victory protected a portion of their annual income from taxation and endowed them with an extra layer of insulation from the prejudicial institution of slavery. Yes, members of their families had been enslaved during the second half of the eighteenth century, but they could confidently claim descent from Indigenous people who had been free during the early years of the Carolina colony. That ancestral legacy, demonstrated in a court of law, provided a degree of psychological comfort that eluded most free people of color in antebellum South Carolina, whose fretted about the shrinking legal boundaries of their conditional freedom as the state drifted toward secession in the middle of the nineteenth century.

At the conclusion of the American Civil War in 1865, the protections afforded to free Indians in Amity with South Carolina evaporated with the rest of the state’s legal code rooted in the practice of race-based slavery. The mix-race people descended from various Indigenous tribes did not disappear, but the usefulness of asserting that lineage evolved. Claiming to be part-Native American might have carried some social value in the twentieth century, but the legal benefits attached to that status a century earlier no longer applied.

Now in the twenty-first century, we might hear African-American friends or family members proudly state that they are part Cherokee, or part Seminole, or have some measure of unidentified Native American ancestry in their family tree. While such claims might be rooted in fact and demonstrated by DNA analysis, I’ll wager there’s another, less familiar legal facet to some of these stories. Perhaps we’re hearing echoes of claims rooted in centuries past, when the act of asserting one’s Indigenous ancestry was a form of legal defense. The descendants of free Indians in amity with the state don’t simply carry specific genetic markers or share some cultural affinity; they share an obscure legal legacy that their ancestors carried proudly like a shield.

[1] Alan Gallay, The Indian Slave Trade: The Rise of the English Empire in the American South (New Haven: Yale University Press, 2002), 49, 51, 52, 57.

[2] See, for example, A. S. Salley Jr., ed., Journal of the Commons House of Assembly of South Carolina for the Session Beginning October 30, 1700 and Ending November 16, 1700 (Columbia: The State Company for the Historical Commission of South Carolina, 1924), 22 (16 November 1700).

[3] Cecil Headlam, ed., Calendar of State Papers. Colonial Series. America and West Indies. Jan.–Dec. 1, 1702 (Hereford Times for His Majesty’s Stationer Office, 1912), 173, 175 (item 260).

[4] South Carolina Act No. 269, “An Act for Regulating the Indian Trade and making it safe to the Publick,” ratified on 19 July 1707, in Thomas Cooper, ed., The Statutes at Large of South Carolina, volume 2 (Columbia, S.C.: A. S. Johnson, 1837), 309–16. The preamble of this law includes the earliest known South Carolina legislative use of the phrase “Indians in amity with this government.”

[5] For more information on this topic, see William L. Ramsey, The Yamasee War: A Study of Culture, Economy, and Conflict in the Colonial South (Lincoln: University of Nebraska Press, 2008); Steven J. Oatis, A Colonial Complex: South Carolina’s Frontiers in the Era of the Yamasee War, 1680–1730 (Lincoln: University of Nebraska Press, 2004).

[6] A. S. Salley, ed., Journal of the Commons House of Assembly of South Carolina November 15, 1726–March 11, 1726/7 (Columbia, S.C.: State Commercial Printing Company for the Historical Commission of South Carolina), 90, 96.

[7] Peter Wood, Black Majority: Negroes in Colonial South Carolina from 1670 through the Stono Rebellion (New York: W. W. Norton, 1974), 143–45.

[8] For more discussion of “mestizo” and other terms, see Jack D. Forbes, Jack D. Forbes, Africans and Native Americans: The Language of Race and the Evolution of Red-Black Peoples (second ed.; Urbana: University of Illinois Press, 1993).

[9] See Act No. 670, “An Act for the better Ordering and Governing Negroes and other Slaves in this Province, ratified on 10 May 1740, in David J. McCord, ed., The Statutes at Large of South Carolina, volume 7 (Columbia, S.C.: A. S. Johnston, 1840), 397–417.

[10] South Carolina Department of Archives and History (hereafter SCDAH), Journal of His Majesty’s Council, No. 30, pages 356–57 (23 November 1764).

[11] The “Negro Act” of 1740 (except such parts repealed or amended by later laws) was made perpetual on 12 March 1783 by Act No. 1161, “An Act for reviving and amending several Acts and Ordinances of the General Assembly,” in Thomas Cooper, ed., The Statutes at Large of South Carolina, volume 4 (Columbia, S.C.: A. S. Johnston, 1838), 540–42.

[12] For a brief overview of this topic, see Terry Lipscomb, “The Magistrates and Freeholders Court,” South Carolina Historical Magazine 77 (January 1976): 62–65.

[13] The case of Adam Garden is summarized in James Albert Strobhart, ed., Reports of Cases Argued and Determined in the Court of Appeals and Court of Errors of South Carolina, On Appeal from the Courts of Law, volume 4 (Columbia, S.C.: A. S. Johnston, 1850), 449, 459–60, as having been decided “by Judge Grimke in 1814.” Note that this summary mentions that Garden had petitioned (without success) Charleston’s City Council on some unspecified date(s) for relief from the city’s annual capitation tax, presumably arguing that his descent from “free Indians in amity with the state” constituted an exemption.

[14] John Mill, ed., Reports of Judicial Decisions in the Constitutional Court of South Carolina, Held at Charleston and Columbia in 1817, 1818, volume 1 (Charleston, S.C.: John Mill, 1819), 194–95; for the City of Charleston’s capitation tax of 1814, see “An Ordinance to raise supplies for the use of the City of Charleston, for year one thousand eight hundred and fourteen,” ratified on 10 March 1814, in Charleston Courier, 11 March 1814, page 2.

[15] Charleston Courier, 5 January 1818, page 3, “General State Tax, For the Year 1817”; Act No. 2172: “An Act to Raise Supplies for the Year One Thousand Eight Hundred and Seventeen; and for other Purposes Therein Mentioned,” ratified on 18 December 1817, in David J. McCord, ed., The Statutes at Large of South Carolina, volume 6 (Columbia, S.C.: A. S. Johnston, 1839), 80–81.

[16] See the will of Peter Basnett Mathewes [sic] of Charleston, “man of colour and butcher by trade,” dated 29 October 1800; proved on 26 November 1800; recorded in SCDAH, Will Book D (1800–1807), 55; WPA transcript volume 28: 56–57.

[17] The names John, Peter, Henry, and Isaac Mathews all appear on two undated petitions presented by a group of free men of color to the South Carolina General Assembly ca. 1818–20, concerning the establishment of an African Methodist Episcopal church at the corner of Reid and Hanover Streets near Charleston. See SCDAH, Petitions to the General Assembly, No Date, petition numbers 1893 and 3997.

[18] An obituary for Mary Taggart in Charleston’s City Gazette, 2 August 1827, page 2, gives her age. In 1783, William Taggart purchased Lot No. 1 and No. 2 of the subdivided estate of Hopkin Price (now No. 41 and No. 43 Meeting Street, respectively), and Mary Taggart sold the latter property; see William Taggart to Commissioners of the Treasury, mortgage, 20 June 1783, CCRD M5: 92–94; Mary Taggart to William Smith, lease and release, 31 July–1 August 1785, CCRD P5: 491–97. Leander Fairchild acquired Lot No. 7 of the estate of Hopkin Price, on the south side of Price’s Alley, in 1783; see Leander Fairchild to Commissioners of the Treasury, mortgage, 20 June 1783, CCRD M5: 90–92; For more information about Fairchild (the father of Nancy Brown), see Charleston Time Machine Episode No. 14 and Episode No. 147.

[19] SCDAH, Miscellaneous Records (Main Series), 4O: 271–72.

[20] Charleston Courier, 1 April 1818, page 2, “Receipt of the State-Tax”; Courier, 10 July 1818, page 3, “The Tax Collector.”

[21] For a biography of Hunt, see John Livingston, Biographical Sketches of Eminent Americans, Now Living (New York: s.n., 1853), 144–60; Alexander Moore, ed., Biographical Directory of the South Carolina House of Representatives, volume 5 (Columbia: University of South Carolina Press, 1992), 132–34.

[22] The surviving records of this case (see below) state that the events of 10 May 1819 occurred “before the Honourable the Justices of the of General Sessions in and for the district and state aforesaid.”

[23] John Mathews et al. vs. Tax Collector of Charleston, SCDAH, Charleston District, Court of Common Pleas, Judgment Rolls, 1819, item 22A. Note that Hunt’s course of action presaged the legal remedy outlined later by John Belton O’Neall in The Negro Law of South Carolina (Columbia, S.C.: John G. Bowman, 1848), Chapter 1, sections 10–14.

NEXT: Watson’s Garden: The Horticultural Roots of Courier Square

PREVIOUSLY: The Native American Land Cessions of 1684

See more from Charleston Time Machine